Status of Corporate Governance

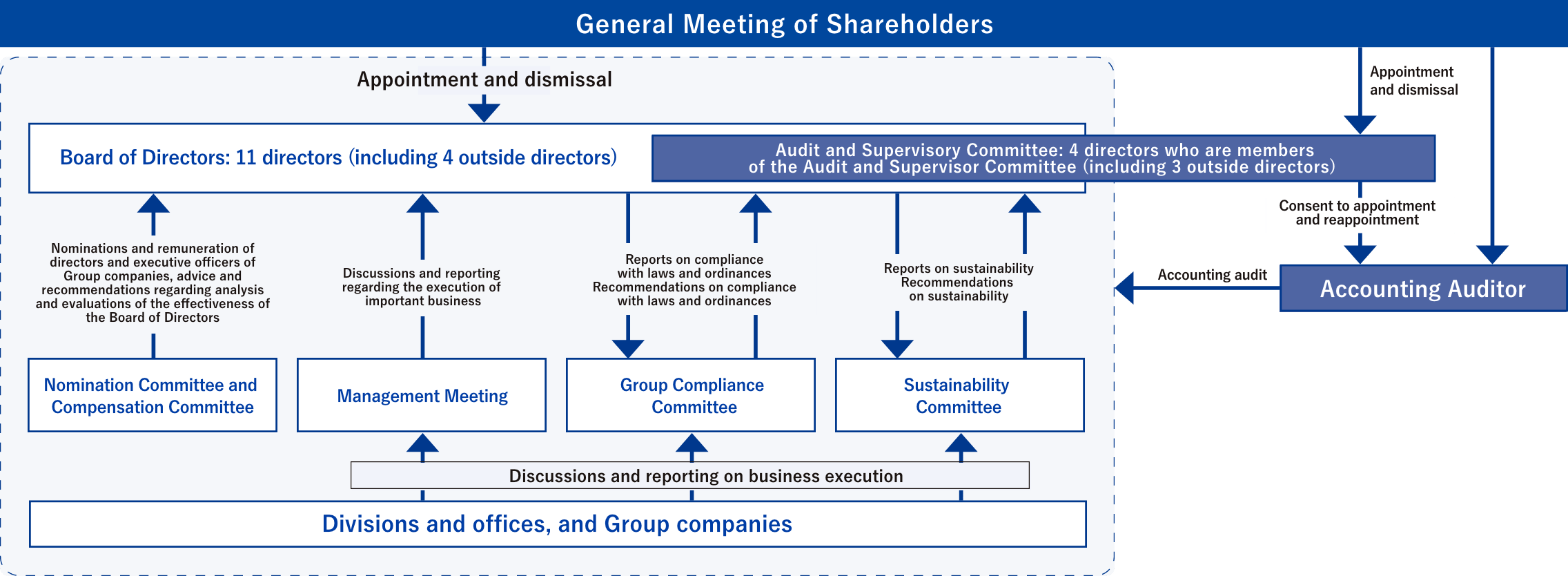

In June 2019, the Company transitioned from a company with a board of corporate auditors to a company with an audit and supervisory committee.

The introduction of the new corporate structure is intended to establish a system capable of flexibly responding to changes in the business environment, and to strengthen the oversight functions of the Board of Directors from diverse perspectives.

Corporate Structure

Executive officer system

The term of office is one year with the aim of clarifying the division of roles between the decision-making/oversight function and the business execution function, and to clarify responsibility for business execution.

Board of Directors

A regular meeting of the Board of Directors is held once a month, in principle, at which decisions are made regarding important matters and the status of business execution by directors is supervised. The Board of Directors assigns directors who are in charge of business execution to carry out such business execution based on the segregation of duties, and directors make the necessary decisions regarding matters delegated to them in accordance with the institutions or procedures stipulated in regulations.

Management Meeting

The Management Meeting comprises directors (excluding outside directors), senior executive officers, superior executive officers, representative directors and presidents of subsidiaries, and the heads of divisions of K’s Denki. The meeting is convened once a month, in principle. Discussions and decision-making are conducted regarding basic and important matters pertaining to the business execution of departments and subsidiaries.

Nomination Committee and Compensation Committee

The Nomination Committee and Compensation Committee are discretionary committees established to ensure the transparency and fairness of the Board of Directors. The committees engage in discussions regarding agenda items for the General Meeting of Shareholders pertaining to the election of directors, agenda items for the Board of Directors pertaining to the election of candidates for executive officer, the details of remuneration and the like for directors and executive officers, and analysis and evaluations regarding the overall effectiveness of the Board of Directors, and also provide advice and recommendations to the Board of Directors.

Audit and Supervisory Committee (4 members, including 3 outside directors)

K’s Denki is a company with an Audit and Supervisory Committee. The committee collaborates with the Internal Audit Office and the auditors of Group companies in supervising business execution by directors in an effort to reinforce management oversight functions.

Remuneration for Officers

The remuneration system for officers is linked to shareholder returns so that officer remuneration serves to contribute to the sustainable growth of the Group and increasing corporate value. Our basic policy in determining the remuneration of individual directors is to set remuneration at appropriate levels commensurate with their responsibilities.

Process of determining remuneration

In determining the remuneration of each director (including senior executive officers), a discretionary Compensation Committee is established to consider the effectiveness of the remuneration system and deliberate on amounts of remuneration for individuals, upon which the final amounts are determined by the Board of Directors. The Compensation Committee is chaired by an outside director, and the majority of its members comprise outside directors. This strengthens the objectivity and transparency of the committee.

Basic remuneration

Basic remuneration for directors is fixed and paid on a monthly basis, and comprises remuneration for the right of representation, remuneration for directorship, and remuneration based on job title. Remuneration based on job title reflects self-evaluations based on the evaluation items of the code of conduct required of officers, and the representative director performs a comprehensive evaluation. Amounts of individual remuneration are resolved by the Board of Directors following deliberation by the Compensation Committee.

Performance-linked remuneration

Amount of performance-linked bonus = Amount of monthly basic remuneration × Number of months’ worth of bonus payment

- Ratio to consolidated ordinary income in previous year

- Number of months’ worth of bonus

- Less than 90%

- 0 months

- Over 90%, less than 100%

- 1 month

- Over 100%, less than 110%

- 1.5 months

- Over 110%

- 2 months

Stock-based remuneration (restricted stock compensation)

The maximum amount and number of shares of restricted stock to be granted are 200 million yen on an annual basis and a total of 200,000 shares, respectively. Our policy is to determine the number of shares to be granted based on calculations linked to an evaluation of the monthly amount of remuneration for each year, and to grant the shares on a fixed date each year.

At the meeting of the Board of Directors held on March 21, 2024, the initiatives related to ESG, such as climate change, were acknowledged as important management challenges and a decision was approved to reflect non-financial indicators related to ESG (CDP climate change scores, etc.) in the evaluation of remuneration for officers.

Policy regarding remuneration for directors who are Audit and Supervisory Committee members

Remuneration is determined through discussions with directors who are Audit and Supervisory Committee members, based on their respective duties.

Total amount of remuneration for each officer category, total amount of remuneration, etc. by type, and number of eligible officers

The table below can be scrolled horizontally.

| Officer category | Total amounts of remuneration (millions of yen) |

Amount of remuneration, etc. by type (million yen) | Number of eligible officers (number of people) |

|||

|---|---|---|---|---|---|---|

| Fixed remuneration |

Performance-linked remuneration | Stock-based remuneration | Non-monetary compensation, etc. from the remuneration on the left | |||

| Directors (excluding Audit and Supervisory Committee members and outside directors) |

237 | 211 | — | 26 | 26 | 6 |

| Directors (Audit and Supervisory Committee members) (excluding outside directors) |

17 | 17 | — | — | — | 1 |

| Outside officers | 27 | 27 | — | — | — | 6 |

Meetings convened

- Name of committee

- Number of meetings

- Board of Directors

- 18

- Audit and Supervisory Committee

- 7

- Nomination Committee and Compensation Committee

- 4

- Management Meeting

- 12

- Group Compliance Committee

- 1

- Sustainability Committee

- 4

Evaluation of the effectiveness of the Board of Directors

We evaluate the effectiveness of the Board of Directors by conducting self-assessments and analysis for the purpose of enhancing the functions of the Board of Directors, which in turn leads to the improvement of corporate value. The self-assessments and analysis involve administering questionnaires to all directors while receiving advice from our corporate attorneys. Questionnaire responses are sent directly to the attorneys’ office to ensure anonymity. Responses to the questionnaires indicate that the effectiveness of the Board of Directors has been maintained at a high level.

The following are issues to be addressed in the future.

We will share issues and challenges concerning the current risk management system and compliance efforts, and identify areas that need improvement.

We will enhance discussions in order to make our sustainability initiatives and investments in intangible assets such as human capital, more proactive and active.

The Board of Directors will verify again if appropriate training opportunities are provided, and by recognizing the issues and making improvements, strive to improve the environment for directors to learn and update their knowledge concerning the Company’s operations, finances, organization, etc., as well as knowledge concerning the roles and responsibilities required of directors.

Based on the effectiveness evaluations, the Board of Directors will consider the above issues and put specific initiatives into practice.

Training policy for directors

The Company provides an environment in which full-time directors can take courses through the e-learning system. Furthermore, the Management Meeting, which comprises the Company’s full-time directors, senior executive officers, representative directors and presidents of subsidiaries, superior executive officers, and heads of divisions of K’s Denki, holds meetings for studying legal and financial matters with outside experts. The Group Compliance Committee, which comprises the same members as the Management Meeting, meets when necessary to cultivate awareness of compliance with laws and ordinances.